March 28, 2019

28 March 2019

Paribas Cardif, the world leader in bancassurance partnerships and creditor insurance[1], had record gross written premiums in 2018 in both the savings and protection insurance segments. The year was marked by the successful launch of Cardif IARD across the Paribas French Retail Banking network. The insurer is successfully moving forward with its digital transformation and continues to deploy its development plan. BNP Paribas Cardif confirms its trajectory for 2020 while sustaining a focus on having a positive impact on society.

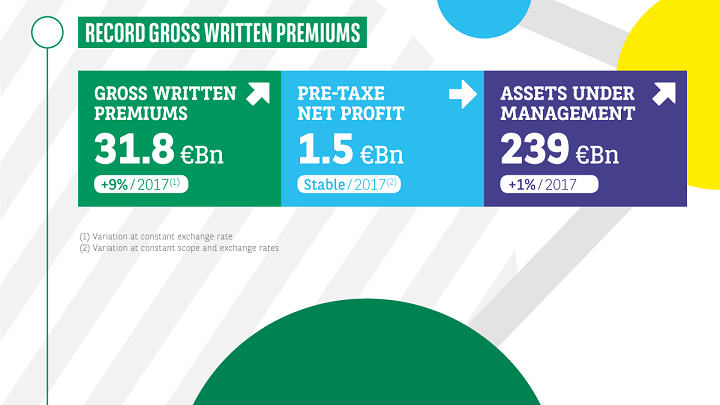

Record gross written premiums

BNP Paribas Cardif reported record gross written premiums, exceeding the 30 billion euro milestone.

-

Gross written premiums for the insurance business of BNP Paribas totalled 31.8 billion euros at year-end 2018, an increase of 9%[2] over 2017. The savings segment reached gross written premiums of 24.7 billion euros, an increase of 10%2 compared with 2017, while the protection insurance segment accounted for 7.1 billion euros (+4%2 compared with the previous year).

-

Pre-tax net profit was 1.5 billion euros. Pre-tax net profit was virtually stable at constant scope and exchange rates (-0.3%), integrating the impact of the downturn in financial markets at the end of the year.

-

At 31 December 2018, BNP Paribas Cardif had 239 billion euros in assets under management, an increase of 1% compared with 2017.

Strategic partnerships in multiple sectors

BNP Paribas Cardif launched or renewed nearly 120 partnerships around the world in 2018, including several strategic partnerships with major players in a diverse range of industries and countries:

-

Retail: BNP Paribas Cardif also expanded its cooperation with HP Tronic, a major player in household appliances, consumer electronics, computers and mobile phones in the Czech Republic and Slovakia.

-

Telecommunications: Orange, one of the world’s leading telecoms operators, selected BNP Paribas Cardif to provide insurance cover for the smartphones and tablets of its clients in France.

-

Banking: 2018 saw the launch of the joint venture created in Japan between BNP Paribas Cardif and Sumitomo Mitsui Trust Bank, an establishment that is part of the country’s fourth-largest banking group.

-

Automobile: In Russia, BNP Paribas Cardif renewed its partnership with RN Bank, a subsidiary of RCI Bank and Services (Renault group).

Another major event in 2018 was the launch in May of the new property and casualty insurance offer from Cardif IARD, a joint venture between BNP Paribas Cardif and Matmut. More than 100,000 policies had already been sold by BNP Paribas retail branches at the end of 2018. The objective is to triple sales of property and casualty policies by 2020 and boost the percentage of BNP Paribas retail clients insured from 8% to 12%.

BNP Paribas Cardif once again demonstrated its ability to seize development opportunities by signing partnerships with major distribution partners. BNP Paribas Cardif now works with 500 partners[3] in 35 countries and counts the largest number of bancassurance partnerships in the world[4].

Building on its experience in creditor insurance, BNP Paribas Cardif is the global leader in this business segment1.

Cardif Forward: concrete progress and confirmation of 2020 objectives

BNP Paribas Cardif continues to actively deploy its 2017-2020 development plan with actions that remain focused on better satisfying its partners and their clients. These objectives are supported by five pillars:

-

Increase profit margins and balance risks,

-

Create new experiences for policyholders and partners,

-

Transform data into value for clients,

-

Increase employee growth and satisfaction,

-

Sustain growth by diversifying business activities.

Several initiatives in 2018 contributed to transforming the client experience:

-

Successful digital transformation of business relations with financial advisors and insurance brokers in France. In early 2018, BNP Paribas Cardif signed a partnership agreement with software developer Manymore. Since then, financial advisors and insurance brokers have been able to progressively transition to a digitized process for savings and retirement contracts offered by BNP Paribas Cardif. These initiatives were extended to protection insurance in February 2019, when the insurer took another step towards digitization of its creditor insurance policy by introducing online completion of the required medical questionnaire. The objective of this new process is to enable 90% of policyholders who subscribe Cardif Liberté Emprunteur[5] mortgage insurance to obtain immediate approval directly online. Between now and 2020, BNP Paribas Cardif will have invested 17 million euros in developing its business with financial advisors and insurance brokers.

-

Solutions aligned with the lifestyles and needs of clients. In June 2018, BNP Paribas Cardif introduced a new personal protection policy marketed by Sumitomo Mitsui Trust Bank in Japan. The Life Cycle Plan enables individuals to select different types of protection cover to match their needs. The policy is simple and easy to understand, making it possible to add or cancel coverage for specific risks throughout the life of the policyholder. The offer provides a single subscription and claims form to simplify the client experience. BNP Paribas Cardif is developing numerous similar offers to adapt to the needs of its clients, both in savings (in Italy, the Power YOUnit contract reinvents investment by adapting to the requirements of the client) and in protection (in Colombia, the insurer offers a complete ecosystem covering information, services and training to help policyholders return to the workforce).

-

Chatbots to support clients and facilitate their experience. BNP Paribas Cardif teams currently have a dozen different chatbots in development around the world to enhance the client experience. In South Korea, KakaoTalk – the most popular instant messaging application in the country – can be used by clients to ask questions or modify their insurance policy. In France, a virtual advisor specialized in inheritance issues helps beneficiaries of a life insurance policy with formalities and answers their questions.

-

Powerful tools to unlock the value in data. BNP Paribas Cardif uses the Domino platform to develop and manage its artificial intelligence algorithms in a single environment that can be accessed from the 35 countries where the insurer is present. Icare, the BNP Paribas Cardif subsidiary specialized in extended warranties and maintenance for motor vehicles, is one of the first entities to leverage this platform with the introduction of a dynamic monitoring model for the complex risks related to its business. Several countries now benefit from this tool, which allows them to automate processes.

Active commitments to society

As a committed insurer, BNP Paribas Cardif works to make insurance available to the largest possible number of people and have a positive impact through all its activities. These commitments encompass every aspect of society.

-

Environment : Socially Responsible Investment (SRI) has been a pillar of BNP Paribas Cardif’s investment strategy for more than a decade. In 2017 the insurer set a target of 2.4 billion euros in green investments by the end of 2020, which it achieved by the end of 2018. BNP Paribas Cardif recently announced that it has raised this objective and is aiming for 3.5 billion euros in green investments by the end of 2020 in order to finance the energy transition and mitigate ecological footprints.

-

Business: BNP Paribas Cardif supports businesses of all sizes in a wide range of sectors. In 2018, the company invested in Elior and Neoen within the framework of the Fonds Stratégique de Participations (FSP, Strategic Equity Fund), in the NOVO fund, which finances growth and innovation for small and mid-size businesses. In addition, BNP Paribas Cardif supports a dozen startups via its C. Entrepreneurs fund. What’s more, by proposing private equity unit-linked vehicles in its life insurance and capitalization contracts since 2016, the insurer contributes to the long-term development of unlisted companies. BNP Paribas Cardif recorded nearly 100 million euros in new cash in private equity at 31 December 2018. All these initiatives support the real economy.

-

Clients: In 2018 BNP Paribas Cardif simplified and digitized the subscription process for creditor insurance in several countries, including France, Belgium and Japan. In France, by the end of 2018, 150,000 policies for clients of BNP Paribas retail banking branches had already benefited from this innovative process. In Belgium, nearly 80% of creditor insurance policies subscribed via brokers were automated. The client experience was also improved in Japan with the introduction of an online medical questionnaire.

-

Employees: The insurer signed a partnership contract last year with General Assembly[6] with a commitment to training 1,000 employees in tomorrow’s in-demand skills by 2022 thanks to the Skill Up programme, designed to enhance their expertise or reskill by learning new competencies. The training kicked off with sessions on data and UX Design[7]. In just a few months, more than 300 people have already been trained. The insurer plans to open these sessions to employees of its partners and the BNP Paribas Group as well.

Appendix

Gross written premiums for the insurance business of BNP Paribas totalled 31.8 billion euros at year-end 2018, an increase of 9%2 over 2017.

Pre-tax net profit was 1.5 billion euros, virtually stable at constant scope and exchange rates (-0.3% compared with 2017). At historical scope and exchange rates, pre-tax net profit declined 20.8%. Results for 2017 were in particular marked by the exceptional impact of a capital gain from the sale of a 4% stake in BNP Paribas Cardif’s Indian subsidiary SBI Life[8].

Domestic markets (France, Italy and Luxembourg) for the BNP Paribas Group’s insurance business recorded gross written premiums of 22.0 billion euros in 2018, an increase of 10.3% compared with 2017.

France had gross written premiums of 14.5 billion euros, an increase of 13.6% compared with 2017. Savings gross written premiums were 13.0 billion euros, an increase of 15.3% over 2017. Inflows in unit-linked contracts represented 30% of total inflows (stable vs. 2017). Protection gross written premiums were stable compared with 2017, reaching 1.5 billion euros. The protection segment covers creditor insurance, personal insurance, property and casualty insurance (gross written premiums for Cardif IARD totalled 162 million euros in 2018), as well as extended warranties for motor vehicles (through the Icare Assurance subsidiary, which recorded gross written premiums of 78 million euros, up 4.3% over 2017).

In Italy, gross written premiums were 4.8 billion euros, an increase of 7.8% compared with 2017. Savings gross written premiums in Italy were 4.1 billion euros, up 8% over 2017. Following lower inflows in the general fund in 2017, the Italian subsidiary posted growth of 14% in 2018, driven by the launch of new products. Gross written premiums from protection insurance totalled 731 million euros, an increase of 6.5% compared with 2017. This growth was led by creditor and property and casualty insurance.

In Luxembourg, gross written premiums at Cardif Lux Vie remained stable at 2.7 billion euros, with 64% of inflows in unit-linked contracts. In December 2018 BNP Paribas Cardif finalized the acquisition of the stake held by Ageas (33.33%) in Cardif Lux Vie, announcing the signature of the final agreement on 31 October 2018. BNP Paribas Cardif is the majority shareholder in Cardif Lux Vie with a 66.67% stake. The interest of BGL BNP Paribas in Cardif Lux Vie remains unchanged (33.33%).

In international markets (Asia, Latin America and Europe, excluding domestic markets), the insurer recorded aggregate gross written premiums of 9.9 billion euros, an increase of 5.1%2 compared with 2017:

Asia had gross written premiums of 4.9 billion euros in 2018 an increase of 6.5%2 compared with the previous year, reflecting business growth in India (+17% vs. 2017) and Taiwan (+5%2 vs. 2017).

Latin America continued its growth momentum in protection insurance with gross written premiums rising to 1.7 billion euros (+4.2%2 vs. 2017), with particularly strong performance in Brazil, Chile and Mexico.

Europe (excluding domestic markets) and emerging markets recorded a 3.5%2 increase over 2017 with gross written premiums of 3.3 billion euros.

[1] Source: Finaccord - 2018

[2] At constant exchange rates

[3] Including banks, financial institutions, consumer credit companies, automobile sector businesses, retailers, telecommunications companies, financial advisors and brokers.

[4] https://www.finaccord.com/Home/About-Us/Press-Releases/PRESS-RELEASE-Insurers-place-an-increasing-emphas

[5] Cardif Liberté Emprunteur, a BNP Paribas Cardif creditor insurance policy marketed by financial advisors and brokers.

[6] General Assembly is a pioneer in professional education and career management specialized in tomorrow’s in-demand skills.

[7] UX Design is the process of creating websites or applications that take into account and anticipate user needs.

[8] At Initial public offering of SBI Life on the Bombay Stock Exchange and the National Stock Exchange of India in October 2017.