April 12, 2023

The Center of Automotive Management (CAM) realised a study for BNP Paribas Cardif, analysing the current transformation in automotive mobility and the development of innovations in the areas of electric-vehicles, autonomous driving, interconnectivity and mobility services.

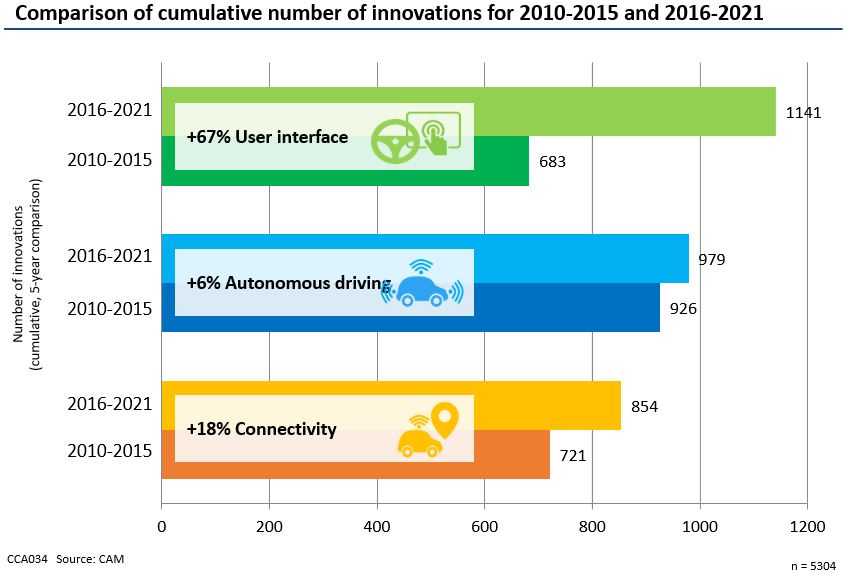

The industry trends concerning connected cars can be seen from the last 10 years innovations of the 28 global automotive manufacturers. Global original equipment manufacturers generated almost 3,000 innovations in the period from 2016 to 2021 in the three sub-areas of user interface, autonomous driving and connectivity. User interface innovations make up the largest share quantitatively since 2015. The number of innovations in the area of operating and display concepts rose by 67% to reach 1,141 innovations between the two periods. A qualitative shift is also apparent, from hardware orientation – in which customers buy built-in features – towards increasing software and services orientation: vehicle hardware is increasingly being configured to enable the customer to be offered new on-demand functions and features by means of target group-specific and context-sensitive over-the-air software updates. New user interfaces that can be control increasingly via artificial intelligence algorithms are being developed in order to offer a broad digital ecosystem of services in vehicles.

The market growth trajectory of e-mobility is the most important trend in the field of passenger vehicle propulsion is continuing to accelerate in the most important market regions, despite the coronavirus and microchip crises. Electric vehicles include pure battery electric vehicles and plug-in hybrid vehicles. The widening of the range of battery electric vehicles and the grant schemes in place in core regions are increasing the acceptance rate of battery electric vehicles among the population and giving rise to a huge increase in registrations.

China remains the leading market for pure electric transport solutions in the first half of 2022. At around 2 million, the figure for new registrations of battery electric vehicles has quadrupled in comparison with 2021 (0.6 million).

On the European market, sales of battery electric vehicles increased to around 0.6 million in the first half of 2022, in contrast to the overall decline in the private passenger vehicle market. The share of battery electric vehicles as a proportion of the total has increased to 12% up 4 percentage points on the first half of 2021. This continuous upward trend is attributable both to the buyer’s subsidy and tax advantages in place in many European countries and to the widening range of battery electric vehicles available, although the growth has currently weakened somewhat owing to supply shortages.

In the United States, new registrations of battery electric vehicles grew faster than in the markets in China and Europe, to a level of around 474,000 units.

|

In addition to innovations related to connected car technology, an increasingly important role will be played by digital ecosystems of networked services in the future. These trends are already apparent among the top automotive manufacturers. Connected services will offer automotive manufacturers potential for revenue generation in the future.

The global connected services market volume is estimated at more than € 200 billion in total in 2030. For the original equipment manufacturer, this can mean additional revenue, as it creates a service ecosystem, thus tying customers to the brand. However, other market participants are also establishing a digital service ecosystem, especially big data players such as Alphabet/Google, Apple and Tencent and Alibaba in China.

Connected services will offer automotive manufacturers considerable potential for revenue generation in the future. In addition to the five use cases considered (highway pilot,city pilot, In car e-commerce, In-car entertainement, Vehicle-to-grid) , it is possible that there are others that could increase the market volume. Ultimately the services will not be tied to a car, but to the relevant customers, who identify themselves by their cloud ID. The advantage for customers is that they can use the booked services on any hardware (in any car), just as they are accustomed to using other services (Netflix etc.) on any device.

Discover the study case of the CAM realised with BNP Paribas Cardif Germany